Payroll is a critical aspect of business operations, encompassing the process of calculating and distributing employee wages and salaries. It involves various tasks, including tracking hours worked, deducting taxes and benefits, and ensuring compliance with labor laws and regulations. Effective payroll management is essential for maintaining employee satisfaction, meeting legal obligations, and fostering financial stability within an organization.

Payroll management plays a crucial role in the success and sustainability of businesses across industries. Some key reasons why payroll is important include.

Payroll management encompasses various components and processes that ensure accurate and timely payment to employees. Some key components of payroll management include.

Despite its importance, payroll management can be complex and challenging for businesses, especially those with limited resources or outdated systems. Some common payroll challenges include.

The payroll industry plays a crucial role in managing employee compensation, tax deductions, benefits administration, and compliance with regulatory requirements. As organizations strive for operational efficiency and accuracy in payroll processing, they encounter various IT development challenges. Understanding and addressing these challenges is essential for streamlining payroll operations and ensuring compliance. Let's delve into the key IT development challenges faced by the payroll industry.

Payroll data contains sensitive information such as employee salaries, social security numbers, bank account details, and tax withholdings. Ensuring the security and confidentiality of this data is paramount to protect against data breaches, identity theft, and financial fraud.

The complex and ever-changing landscape of tax regulations poses a significant challenge for payroll processing. Organizations must stay compliant with federal, state, and local tax laws, including payroll taxes, withholdings, deductions, and reporting requirements.

Payroll systems need to seamlessly integrate with HR management systems (HRMS) and accounting software to synchronize employee data, payroll transactions, benefits administration, and financial reporting.

Scalability and performance are critical considerations for payroll systems, especially for organizations experiencing growth, seasonal fluctuations, or increased transaction volumes.

Providing a user-friendly interface and accessible payroll system is essential for employee self-service, manager approvals, and HR administration.

Payroll management is a critical function for businesses of all sizes, ensuring accurate and timely payment to employees while maintaining compliance with tax regulations and labor laws. Maxaix leverages cutting-edge technology and industry expertise to deliver comprehensive payroll solutions that streamline processes, reduce costs, and enhance organizational efficiency. Let's explore how Maxaix delivers tangible business value in the realm of payroll management.

Maxaix offers a suite of comprehensive payroll solutions tailored to meet the diverse needs of businesses across industries. Our payroll services encompass.

Maxaix leverages automation technologies to streamline payroll processes and improve operational efficiency. Our automation capabilities include:

Data security is paramount in payroll management, and Maxaix prioritizes robust security measures to safeguard sensitive employee information. Our security protocols include:

Maxaix's payroll solutions are designed to scale with businesses as they grow and evolve. Our scalable and flexible features include:

Staying compliant with changing tax laws, labor regulations, and reporting requirements is crucial for businesses. Maxaix offers.

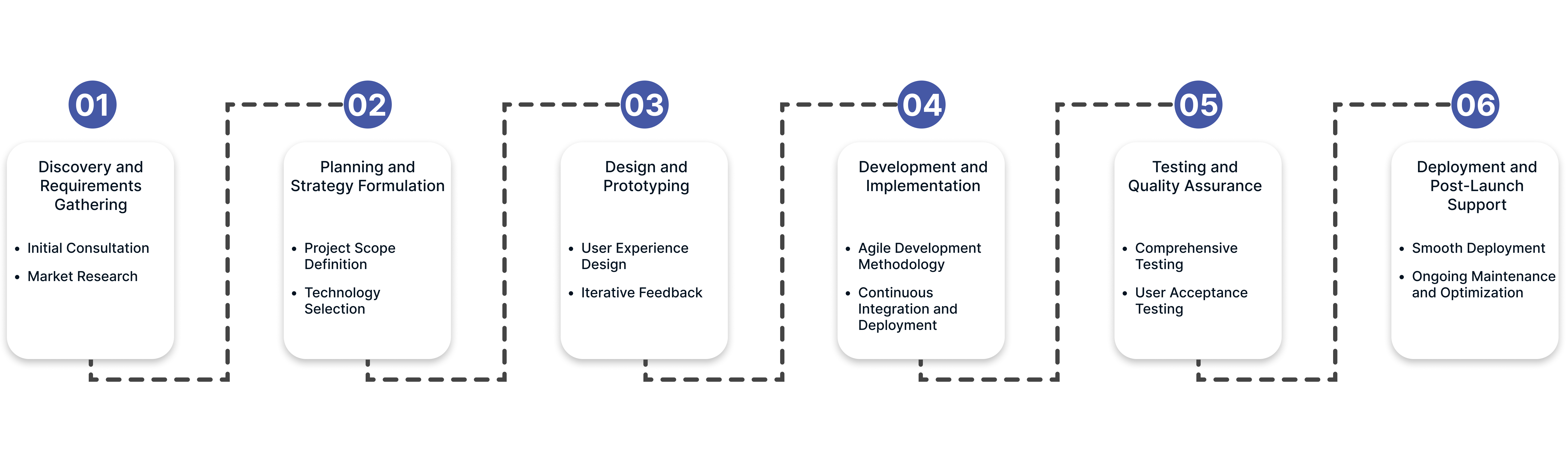

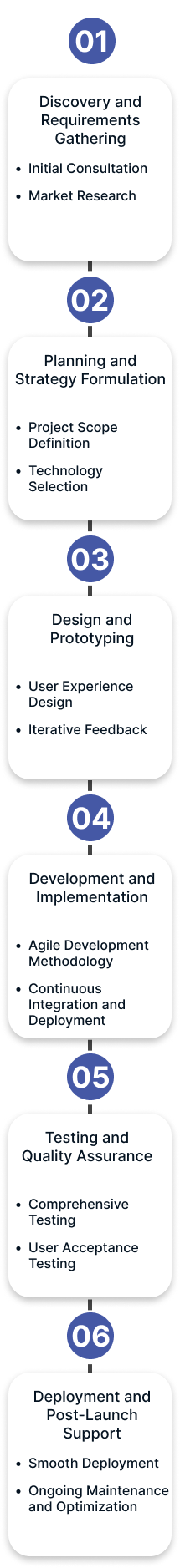

Maxaix is committed to delivering cutting-edge payroll solutions that streamline processes, enhance accuracy, and empower businesses to manage their workforce efficiently. Our development work process is meticulously designed to address the unique needs and challenges of payroll management, ensuring compliance, security, and scalability. Let's delve into the key stages of our development work process for payroll solutions.